Sage 300 (formerly known as Accpac Advantage) has lots of features that make bank reconciliation and tying the balances to the GL easy. (link to the Tie GL article). In Sage 300, all bank oriented transactions flow to the BK module. Each bank record has a bank id, an associated GL number, and banking information such as the routing number which can be used for EFT’s and check printing.

Warning: Do not post reconciliations until the very end

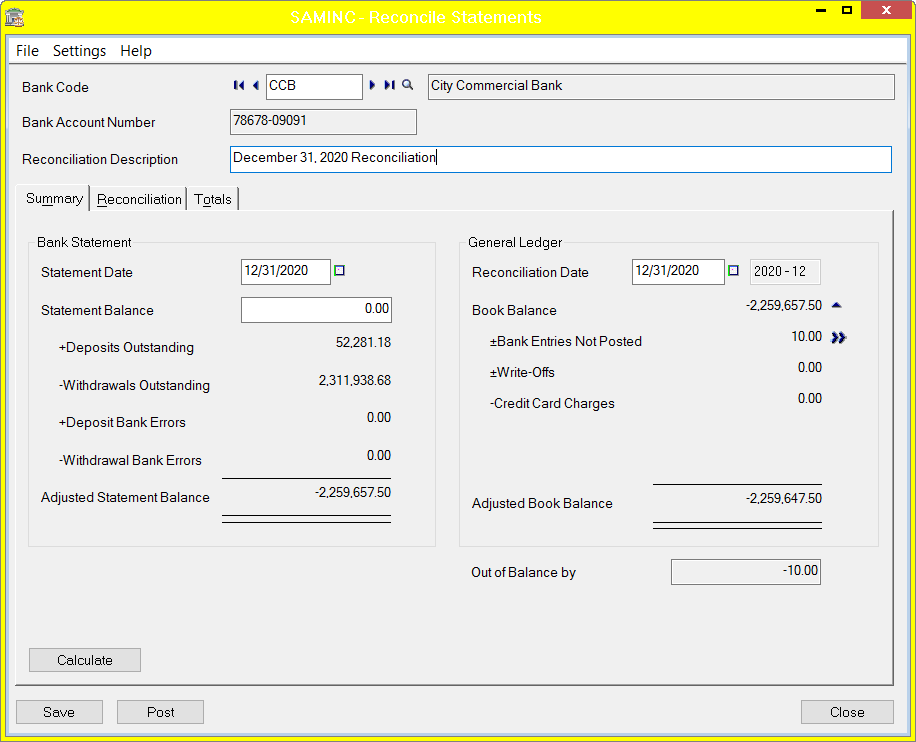

There is a tempting "post" button at the bottom of the reconciliation screen. Wait until you are all done with the statement until clicking it. Sage 300 has a feature that you can't post reconciliations dated earlier than the highest calendar date. So, if you post a rec for a certain bank for Nov 30, 2021, you can't post for April 30, 2021 for that same bank afterwards.

Nice Feature List

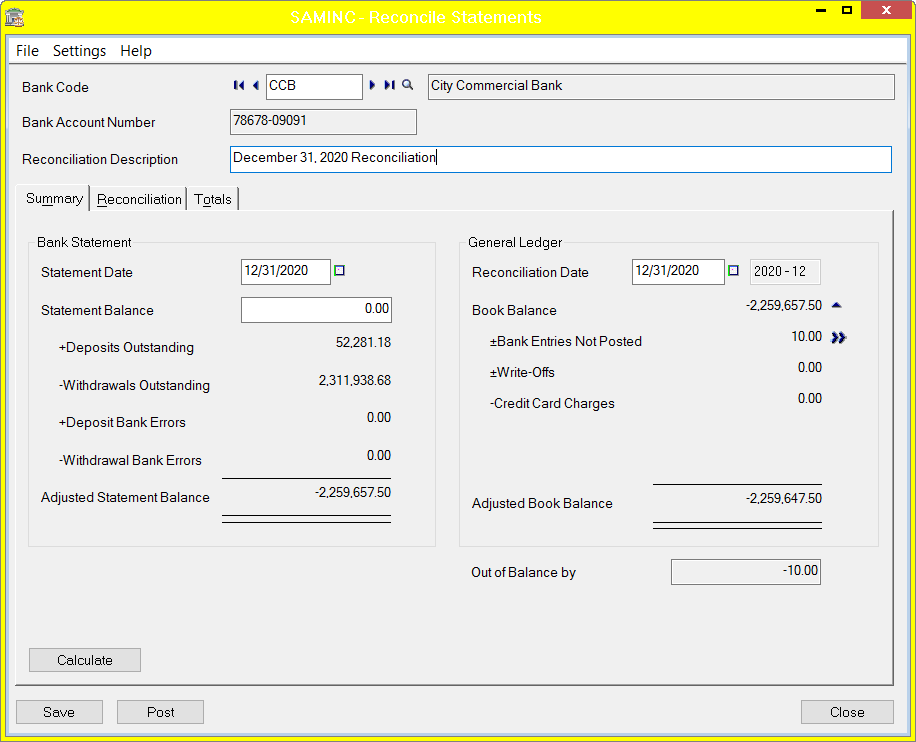

- Bank sub-ledger balance (Book Balance) is compared to the GL balance is compared to statement balance in the reconcile screen To refresh these numbers, possibly picking up newly entered transactions, select the calculate button.

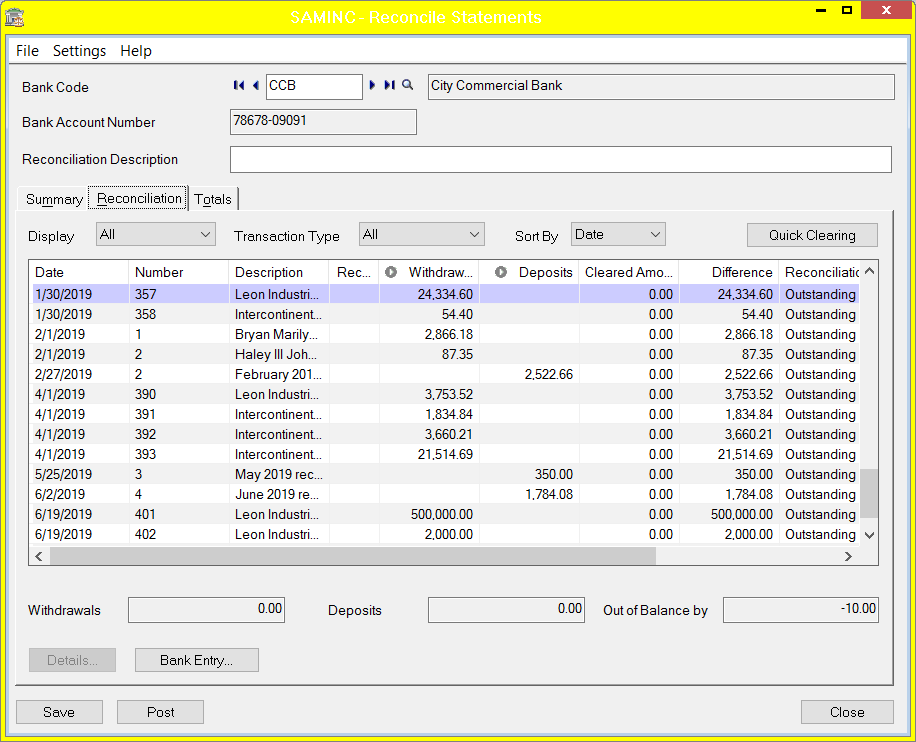

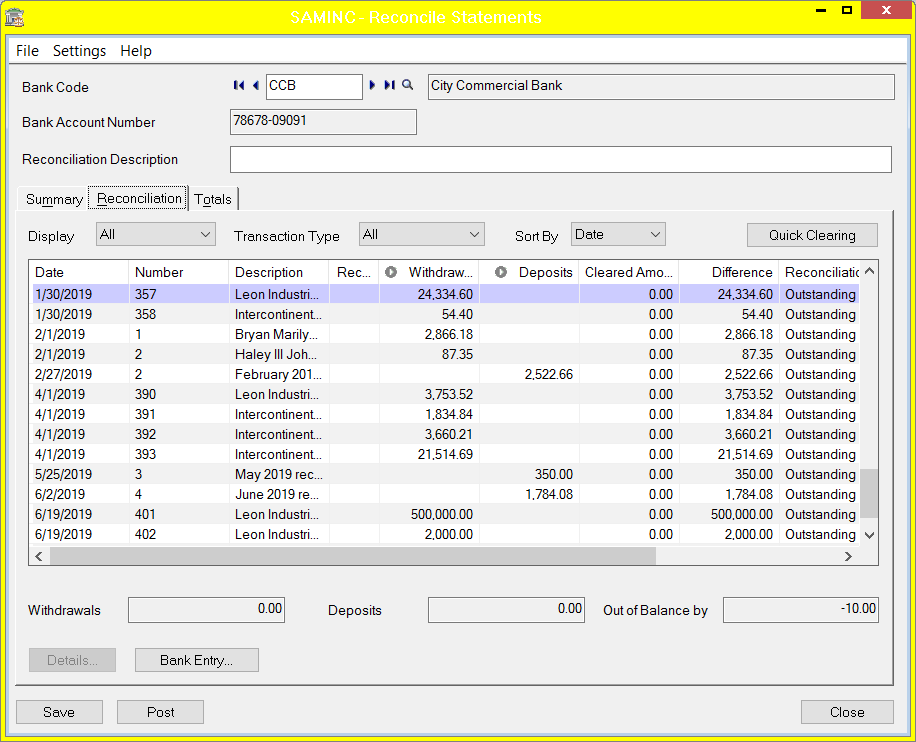

- Total deposits and total withdrawals in the reconcile detail screen (See the picture below, right above where it says "bank entry").

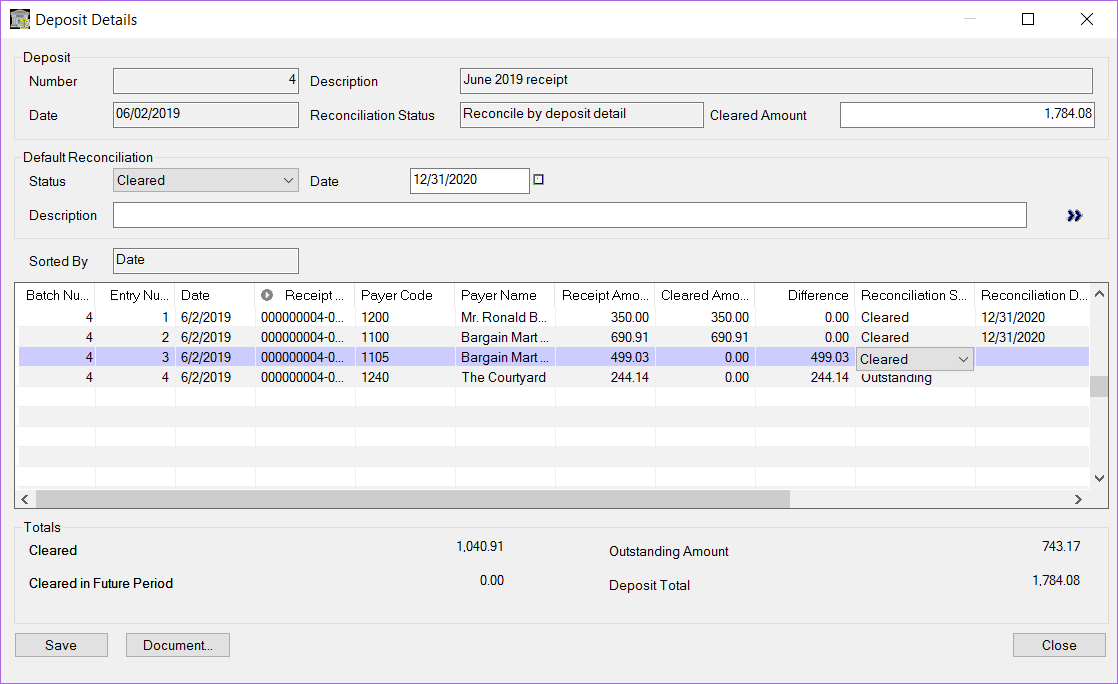

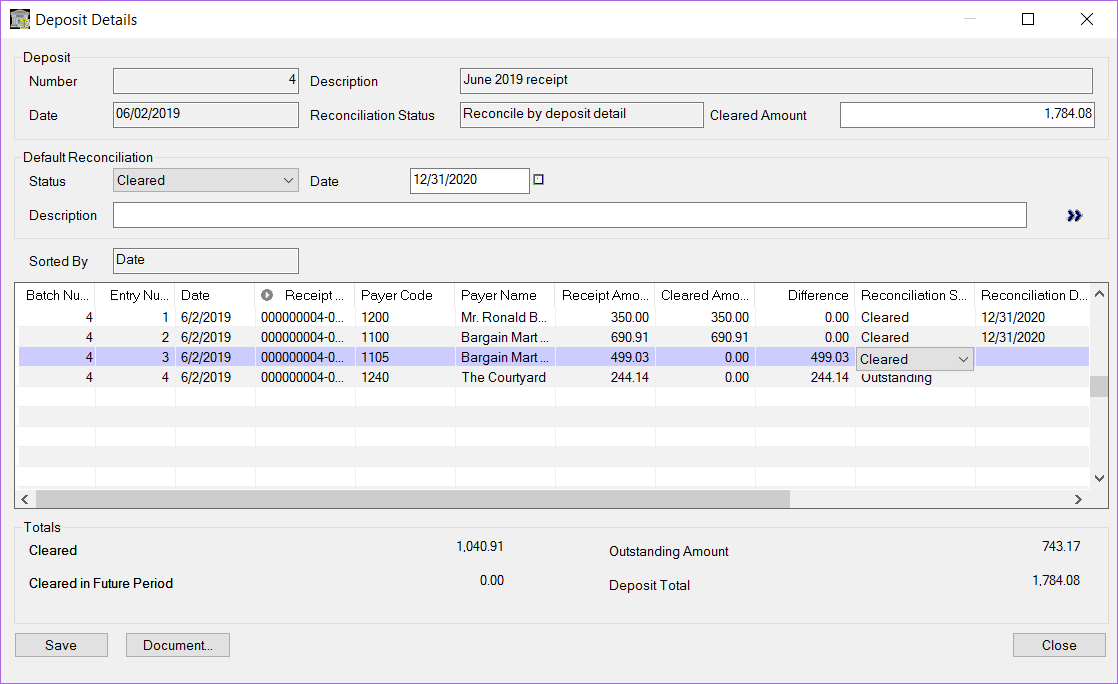

- You can reconcile deposits in detail. For example, if there are four credit card payments for a given posting date, of which post on one statement, and the last of which posts on another statement, you can clear just the four for the statement you are working on, and clear the last one on the next statement.

Recommended for Efficiency

- If your bank can output transactions in QuickBooks OFX format, you can import the transactions using the "import OFX Transactions" and the "Reconcile OFX Transactions" icons. This will have the advantage that the transactions have the correct date and other memo type detail already entered, saving time, and increasing detail in case of future audits. These two processes will be covered in a future blog article.

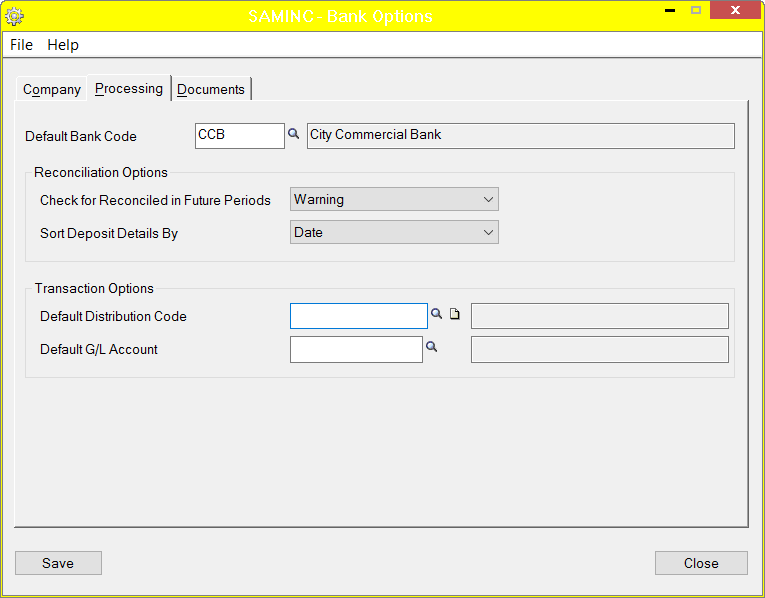

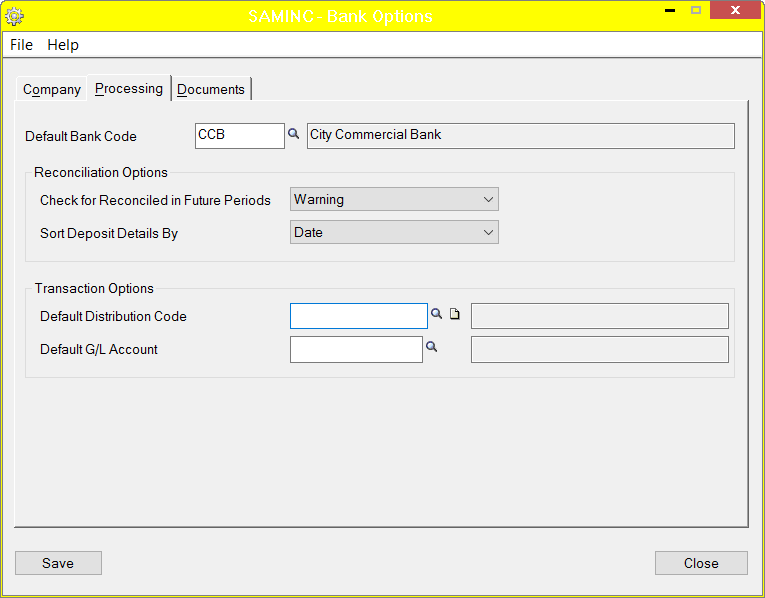

- In Setup, select the bank you are working on as the default bank code. In the example below, CCB has been selected. This way, you don't accidentally enter bank entries in the wrong bank.

- Reconcile deposits and compare to statement deposits total. The deposits in the statement should already have been entered in AR.

- Reconcile checks and compare to statement checks total. The checks should have already been entered in UP, CP, AP, or AR.

- Enter un-entered service charges and other withdrawals. For a bank statement, this might be as few as zero, but for a credit card statement, (credit card blog article) if you enter the charges after the fact like many companies do, there will be quite a few to enter. To speed that up

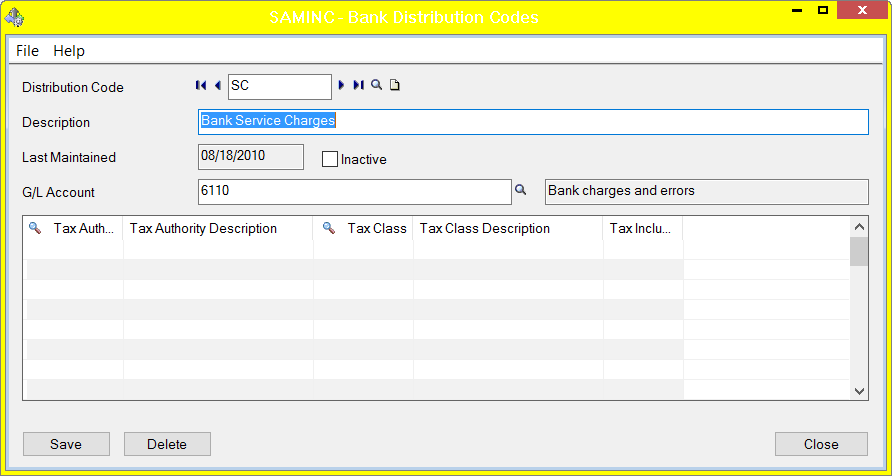

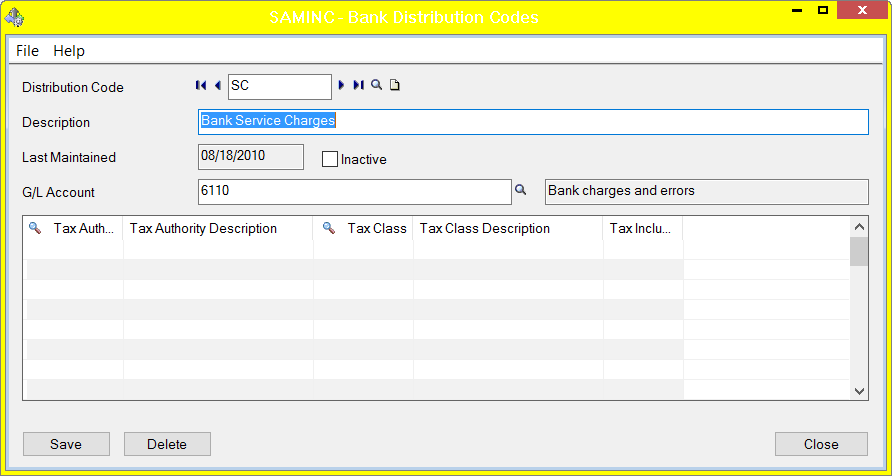

- Use the BK distribution codes to quickly select the correct GL account during data entry. For example, if you have a lot of marketing-related charges on the credit card, make up a code like MKTG which automatically points to the GL account for marketing expense. The example below uses "SC" to select the bank charges account.

- Be very careful to enter the date correctly.

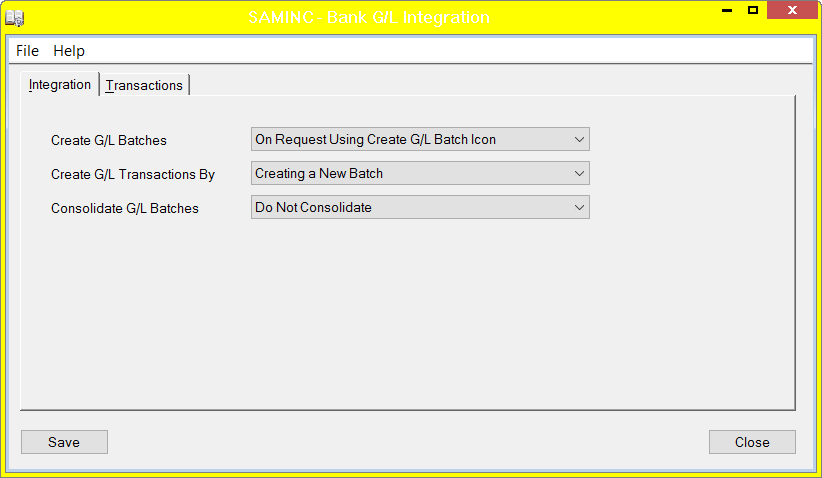

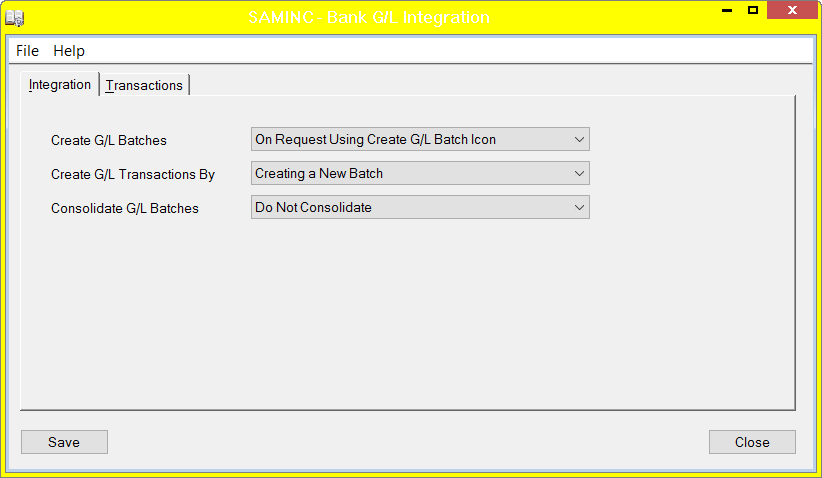

- Turn off the auto-create GL Batch feature in GL integration and wait until the totals reconcile to 0 before posting the bank entries. That way, you can correct date and amount errors without reversing, and a slightly annoying posting detail message doesn't appear for every bank entry you make.

- Reconcile all other withdrawals (e.g. service charges.

- Once the bank reconciles to the statement, then post the GL batch and make sure the bank reconciles to the GL. If it doesn’t, check the GL transaction files to see if there was a journal entry made directly to the GL account.

- If you thought there are entries that were accidentally made in a future date from the statement, it is fast and easy to change the date on the reconciliation to the end of the year and then go into the "reconcile" screen to see if those records appear with the wrong date.

Once you get the hang of this process, you will probably find like I have that you like Sage 300 reconciliations a whole lot better than Sage Pro or Quickbooks reconciliations.